The Risks of Providing Mortgages and Loans to High-Risk Borrowers

In the world of finance, one fundamental rule often guides lenders: “Don’t loan money to people who can’t pay it back.” This principle is particularly pertinent when discussing mortgages and other significant loans. The financial crises and housing market collapses of the past have often been attributed, at least in part, to the neglect of this basic lending rule.

The Basics of Lending

At its core, lending involves risk assessment. Financial institutions extend credit to individuals based on their ability to repay the loan, determined by factors like income, credit history, and the stability of their job. However, when lenders overlook these criteria and approve loans for high-risk borrowers, they expose themselves and the broader economy to significant risks.

The Mortgage Crisis Example

A prime example of the consequences of neglecting Lending Rule 101 is the 2008 global financial crisis. In the years leading up to the crisis, banks increasingly approved subprime mortgages to borrowers with poor credit histories and uncertain income streams. This practice was driven partly by the lucrative market for mortgage-backed securities, where these risky loans were bundled and sold to investors.

The Fallout

- Foreclosures: As many of these high-risk borrowers defaulted, foreclosures skyrocketed, leading to a collapse in the housing market.

- Economic Recession: The ripple effect of the housing market collapse triggered a global economic downturn.

- Bank Failures: Financial institutions faced massive losses due to non-repayment of loans, leading to significant bank failures and bailouts.

The Importance of Lending Rule 101 in Mortgages and Loans

Protecting the Economy

Adhering to the principle of not lending to those who cannot repay is crucial for the stability of the financial system. Risky lending practices can lead to widespread defaults, harming the housing market and, by extension, the entire economy.

Ethical Lending

Lending responsibly is not just an economic issue but also a moral one. Predatory lending practices often target the most vulnerable populations, trapping them in a cycle of debt and financial instability.

Regulatory Response

In response to the mortgage crisis, governments and regulatory bodies have tightened lending standards to prevent a repeat of the past. Regulations like the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States were enacted to ensure more rigorous credit checks and responsible lending practices.

Moving Forward

For a healthy financial ecosystem, it is essential that lending institutions adhere to the basic rule of not extending credit to those who are unlikely to repay. This requires:

- Strict Credit Assessments: Lenders must rigorously assess a borrower’s ability to repay a loan.

- Transparency: Financial institutions should be transparent about the terms and risks of loans, both to borrowers and investors.

- Regulatory Oversight: Continuous oversight and regulation are necessary to prevent reckless lending practices.

Conclusion

“Lending Rule 101: Don’t loan money to people who can’t pay it back” is a simple yet profound principle that, when neglected, can lead to severe economic consequences. The mortgage crisis of 2008 serves as a stark reminder of the dangers of irresponsible lending. As we move forward, it is crucial for the stability and integrity of the financial system to uphold this fundamental rule of lending.

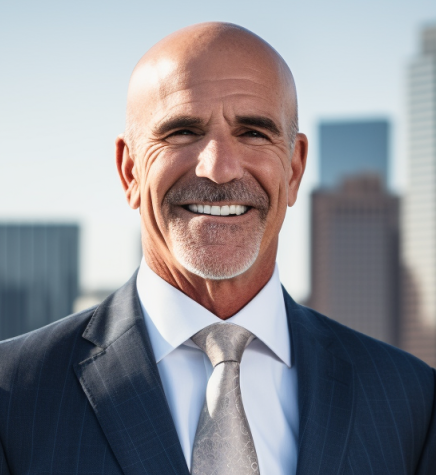

Too discrete to give his real age (but certainly in the grizzled veteran bracket), Tom is an Army brat who spent much of his childhood overseas. After moving back to Florida in the 80’s with his family, Tom worked a variety of jobs after college before finding his calling in the mortgage industry. Now, adding his decades worth of experience to this site, Tom hopes to help others with his knowledge.

After working through the 2008 crisis in a hard hit bank, Tom knows only too well the impact his industry has on people’s lives. Now semi-retired, Tom spends his days keeping up with the latest news in the mortgage industry (and finding the odd hour or three to fish).