Introduction

Have you ever thought about how technology, especially AI, is changing the game in various industries? Today, let’s look at AI in the mortgage industry. It’s a field where, traditionally, you’d expect a lot of paperwork and perhaps a somewhat slow process. But guess what? AI is turning this around, making things faster, smarter, and more user-friendly.

For those of us in the twilight of our careers in the mortgage or real estate industries AI will perhaps not effect us so much. For those just starting out or in the prime of their careers, however, there can be no doubt that it will have a ground shattering impact.

So, let’s embark on this journey to understand this transformation.

Chapter 1: The Magic of Automated Underwriting

The Old vs. The New

Remember the old days when getting a mortgage approved felt like waiting for a pot to boil? Traditional underwriting was like that – slow and sometimes frustrating. But AI has changed the game here. It’s like having a super-smart assistant who can sift through tons of data in no time.

AI-Driven Underwriting: A Quick Look

- Speed: We’re talking minutes, not days!

- Accuracy: Less human error, more precision.

- Cost-Effectiveness: Less manual work means saving bucks.

- Customer Experience: Smooth, fast, and less hair-pulling.

AI: The Friendly Guide

Imagine having a helpful buddy who’s available 24/7 to answer your mortgage questions. That’s what AI chatbots in the mortgage industry are like. They guide you through the application process, making it feel like a walk in the park.

Chapter 2: Risky Business Made Less Risky

Predicting the Future

AI isn’t just fast; it’s also like a crystal ball for lenders. It looks at an unbelievable amount of data and predicts trends and risks. This means lenders can make smarter decisions and avoid potential pitfalls.

Operation Efficiency: Like a Well-Oiled Machine

AI in mortgages isn’t just about interacting with customers. It’s also about making the whole back-end process smoother and error-free.

AI in Action: Streamlining Operations

- Document Processing: Goodbye, manual errors!

- Data Entry: Quick and accurate – no more typos.

- Compliance Checks: Keeping up with regulations without breaking a sweat.

Big Data: The Goldmine

Imagine having a treasure map that shows where to find gold. That’s what big data is for lenders. It helps them understand market trends and customer needs better. So, they can tailor their services just for you!

Chapter 3: Personal Touch with AI

Tailor-Made Solutions

AI doesn’t just process information; it understands your unique needs. This means getting mortgage options that fit you like a glove.

Proactive Engagement

AI doesn’t wait for things to happen. It reaches out with advice and solutions at the right time, building a stronger bond between you and your lender.

Educating Customers

AI also plays the role of a teacher. It breaks down complex mortgage concepts into easy-to-understand bits. This way, you’re not just applying for a mortgage; you’re learning about it too.

Chapter 4: Enhancing Customer Experience with AI

AI: The Friendly Mortgage Advisor

Ever wished for a mortgage advisor who’s available anytime, anywhere? AI makes this possible. With AI-powered tools, you get instant responses to your queries, advice tailored to your financial situation, and a much more interactive experience. It’s like having a personal mortgage consultant in your pocket.

Streamlining Application Processes

Gone are the days of endless forms and confusing procedures. AI simplifies the mortgage application process, making it more intuitive. You get step-by-step guidance, and the AI ensures you fill out everything correctly. It’s like a smooth road trip instead of a bumpy ride.

Keeping You Updated

AI also keeps you in the loop throughout your mortgage journey. Regular updates, alerts about important deadlines, and reminders for necessary documents – it’s all handled by AI. You’re never in the dark about where you stand in the process.

Chapter 5: AI’s Role in Decision Making

Data-Driven Decisions

In the mortgage industry, making informed decisions is crucial. AI provides lenders with a wealth of data-driven insights, allowing them to make better choices about loan approvals, interest rates, and more. It’s like having a crystal ball that actually works!

Customized Mortgage Offers

AI analyzes your financial background and current market conditions to offer the best mortgage solutions for you. It’s like having a mortgage plan crafted just for your unique situation.

Fraud Detection

One of AI’s significant roles is detecting and preventing fraud. By analyzing patterns and spotting anomalies, AI can identify potential fraudulent activities, protecting both lenders and borrowers. It’s like having a vigilant guard protecting your financial interests.

Chapter 6: AI and Regulatory Compliance

Navigating the Legal Maze

The mortgage industry is heavily regulated, and keeping up with these regulations can be daunting. AI helps lenders stay compliant by automatically updating systems with new rules and regulations. It’s like having an expert legal advisor on your team.

Automated Compliance Checks

AI systems can automatically check loan applications for compliance, ensuring all procedures are followed correctly. This reduces the risk of legal issues and speeds up the approval process. It’s like having a meticulous inspector reviewing every detail.

Chapter 7: The Future of AI in Mortgages

Continuous Learning and Improvement

AI systems are not static; they learn and improve over time. This means the mortgage process will become even more efficient, personalized, and user-friendly in the future. We’re looking at a future where getting a mortgage could be as easy as shopping online.

Expanding Accessibility

AI opens up new possibilities for those who might have been overlooked by traditional mortgage processes. With more accurate risk assessments, AI can help lenders offer mortgages to a broader range of customers.

Building Trust and Transparency

AI can also help build trust between lenders and borrowers by providing transparent processes and clear explanations. It’s about creating a relationship based on understanding and mutual benefit.

Chapter 8: AI-Powered Risk Assessment and Management

Predictive Analytics for Risk Assessment

AI’s ability to predict risks is like having a financial fortune teller. It analyzes past and current data to foresee potential loan defaults or market downturns. This means lenders can make more informed decisions and mitigate risks before they become problems.

Dynamic Risk Management

The mortgage industry is dynamic, with risks changing constantly. AI continuously monitors and adjusts to these changes, providing real-time risk management. It’s like having a vigilant watchman always on duty, ensuring everything is running smoothly.

Enhanced Loan Servicing

AI doesn’t just stop at the loan origination process. It extends its capabilities to loan servicing, managing risks throughout the loan’s lifecycle. This ongoing monitoring and management help in maintaining a healthy loan portfolio.

Chapter 9: AI and Operational Efficiency

Streamlining Back-End Processes

AI transforms the back-end operations of mortgage companies, automating routine tasks like document verification and data entry. This not only speeds up processes but also reduces human errors, making the entire operation more efficient and reliable.

Cost Reduction and Efficiency

By automating and optimizing various processes, AI significantly reduces operational costs. This efficiency is not just about saving money; it’s about enhancing the overall productivity of the mortgage industry.

Impact on Workforce

AI also impacts the workforce by shifting the focus from mundane tasks to more strategic roles. Employees can now concentrate on tasks that require human judgment and expertise, adding more value to the business.

Chapter 10: The Challenges and Considerations of Implementing AI

The Challenge of Integration

Integrating AI into existing systems can be challenging. It requires careful planning, resources, and training. But, like fitting puzzle pieces together, once done, the picture of efficiency and effectiveness is clear.

Data Privacy and Security

With AI handling vast amounts of sensitive data, data privacy and security become paramount. Ensuring robust security measures and complying with data protection laws is crucial. It’s about safeguarding the trust of customers and maintaining the integrity of the industry.

Ethical Considerations

The use of AI in mortgages also brings ethical considerations, such as bias in AI algorithms. Ensuring fairness and transparency in AI decision-making is essential to prevent any form of discrimination. It’s about doing what’s right, not just what’s easy.

Chapter 11: Looking Ahead – The Future of AI in Mortgages

Continuous Innovation

The future of AI in the mortgage industry is bright and filled with continuous innovation. With advancements in AI technologies, we can expect even more streamlined processes, smarter risk assessments, and personalized customer experiences.

The Human-AI Collaboration

The future is not just about AI; it’s about how humans and AI collaborate. By combining AI’s efficiency with human empathy and judgment, the mortgage industry can reach new heights of customer satisfaction and operational excellence.

Shaping a Better Future

AI is not just transforming the mortgage industry; it’s shaping a better future for both borrowers and lenders. A future where mortgages are more accessible, processes are transparent, and decisions are fair and informed.

Chapter 12: AI-Enhanced Customer Support and Services

Round-the-Clock Assistance

With AI, mortgage providers can offer 24/7 customer support, a significant leap from the traditional 9-to-5 service hours. This means you can get answers to your queries or assistance with your application anytime, making the mortgage process more convenient and less stressful.

Personalized Communication

AI enables personalized communication with customers. Based on your interaction history and preferences, AI can tailor its responses and advice, making the communication more relevant and engaging. It’s like having a conversation with someone who truly understands your needs.

Feedback and Continuous Improvement

AI systems can collect and analyze customer feedback in real time, allowing mortgage providers to continuously improve their services. This dynamic adaptability ensures that the services keep evolving to meet customer expectations better.

Chapter 13: The Impact of AI on Mortgage Fraud Detection

Advanced Fraud Detection Techniques

AI introduces advanced techniques for detecting and preventing mortgage fraud. By analyzing patterns and inconsistencies in application data, AI can identify potential fraudulent activities with greater accuracy than traditional methods.

Real-Time Monitoring

AI systems provide real-time monitoring of transactions and applications. This means any suspicious activity can be detected and addressed immediately, reducing the risk of fraud significantly.

Enhanced Security for Customers

The advanced fraud detection capabilities of AI provide an added layer of security for customers. This reassurance is crucial in building and maintaining trust in the mortgage process.

Chapter 14: AI and the Future of Mortgage Marketing

Targeted Marketing Strategies

AI enables mortgage companies to develop targeted marketing strategies. By analyzing customer data, AI can identify potential customers and tailor marketing messages to suit their specific needs and preferences.

Predictive Analytics for Market Trends

AI’s predictive analytics can identify emerging market trends, helping mortgage companies to adjust their products and marketing strategies accordingly. This foresight ensures that companies stay competitive and relevant in a rapidly changing market.

Enhancing Customer Engagement

AI can also enhance customer engagement by providing timely and relevant information, offers, and advice. This proactive approach not only attracts new customers but also strengthens relationships with existing ones.

Chapter 15: Overcoming Challenges and Embracing AI

Addressing the Skill Gap

Implementing AI in the mortgage industry requires a workforce skilled in technology and data analytics. Investing in training and development is crucial to bridge this skill gap and fully leverage AI’s potential.

Balancing Automation and Human Touch

While AI brings efficiency and accuracy, the human touch remains vital, especially in customer service and decision-making. Finding the right balance between automation and human intervention is key to a successful AI implementation.

Ensuring Ethical AI Use

As AI plays a more significant role in the mortgage industry, ensuring its ethical use becomes imperative. This includes addressing issues like algorithmic bias and ensuring transparency in AI-based decisions.

Chapter 16: The Integration of AI with Other Technologies

Combining AI with Blockchain

The fusion of AI with blockchain technology in the mortgage industry promises enhanced security and transparency. Blockchain’s decentralized nature ensures secure and tamper-proof recording of transactions, while AI provides the intelligence to analyze and optimize these processes.

AI and the Internet of Things (IoT)

Integrating AI with IoT devices can offer innovative solutions in property valuation and monitoring. Smart sensors and IoT devices can collect real-time data about a property’s condition, which AI can analyze to provide more accurate valuations and risk assessments.

Cloud Computing and AI

Cloud computing provides the necessary infrastructure for AI’s vast data storage and processing needs. This synergy allows for scalable and flexible AI solutions, enabling mortgage companies to adapt quickly to changing market demands.

Chapter 17: AI’s Role in Sustainable and Inclusive Lending

Promoting Sustainable Lending Practices

AI can aid in promoting sustainable lending practices by analyzing environmental and social impacts of mortgage loans. This analysis can help lenders in making responsible lending decisions that align with broader sustainability goals.

Enhancing Financial Inclusion

AI’s advanced risk assessment capabilities can identify creditworthy individuals who may have been overlooked by traditional credit scoring methods. This opens up mortgage opportunities to a wider, more diverse set of borrowers, enhancing financial inclusion.

AI and Affordable Housing

AI can also contribute to affordable housing initiatives. By efficiently processing and analyzing data, AI can help identify areas where affordable housing is most needed and aid in the development of suitable lending products.

Chapter 18: The Evolving Regulatory Landscape for AI in Mortgages

Keeping Up with Regulatory Changes

As AI becomes more prevalent in the mortgage industry, regulatory bodies are updating rules to include AI governance. Staying abreast of these changes and ensuring compliance is crucial for mortgage companies.

Developing Standards for AI Use

There’s a growing need for developing industry-wide standards for AI use in mortgages. These standards would ensure consistency, reliability, and ethical use of AI across the industry.

The Role of Governments and Institutions

Governments and financial institutions play a significant role in shaping the regulatory framework for AI in mortgages. Their involvement is key in ensuring that AI is used responsibly and benefits the industry and consumers alike.

Chapter 19: Preparing for the Future of AI in Mortgages

Investing in AI Research and Development

Continued investment in AI research and development is essential for the mortgage industry to keep pace with technological advancements and stay competitive.

Fostering Collaboration and Partnerships

Collaboration between technology providers, mortgage companies, and regulatory bodies is vital. These partnerships can drive innovation, ensure regulatory compliance, and promote best practices in AI use.

Embracing Change and Adaptability

The mortgage industry must embrace change and remain adaptable to fully harness AI’s potential. This involves being open to new technologies, rethinking traditional processes, and being willing to invest in the future.

Chapter 20: The Human Element in AI-Driven Mortgages

Maintaining the Personal Touch

While AI brings efficiency, it’s crucial to maintain a personal touch in customer interactions. Human empathy and understanding remain key in handling complex cases and providing a sense of assurance to borrowers.

Training Staff for AI Integration

The successful implementation of AI in the mortgage industry also depends on training staff to work alongside AI tools. This involves not just technical training but also adapting to new roles where human judgment and AI recommendations complement each other.

Building Trust through Transparency

Transparency in AI operations helps in building trust with customers. Explaining how AI works and how decisions are made can demystify AI processes, making customers more comfortable with automated decisions.

Chapter 21: The Challenges of Data Management in AI

Ensuring Data Accuracy

The effectiveness of AI depends largely on the quality of data fed into it. Ensuring the accuracy and relevance of this data is a significant challenge, requiring constant monitoring and validation.

Balancing Data Collection with Privacy

While collecting data is essential for AI, it’s equally important to respect customer privacy. Balancing data collection with privacy concerns and regulations is a delicate task that requires careful navigation.

Overcoming Data Silos

In many organizations, data is stored in silos, making it difficult for AI systems to access and analyze it comprehensively. Breaking down these silos is crucial for the holistic application of AI in the mortgage process.

Chapter 22: AI’s Impact on Mortgage Product Innovation

Developing New Mortgage Products

AI’s data analysis capabilities enable lenders to develop innovative mortgage products tailored to specific market segments. These products can cater to unique borrower needs, offering more flexibility and choice.

Dynamic Pricing Models

AI can also help in implementing dynamic pricing models for mortgages. By analyzing market conditions and individual borrower profiles, AI can assist in setting competitive and fair interest rates.

Enhancing Loan Modification Programs

AI can play a significant role in loan modification programs, identifying borrowers who might benefit from such modifications and suggesting optimal terms based on their financial situation.

Chapter 23: The Future Landscape of Mortgage Brokers and Agents

Changing Role of Brokers and Agents

The role of mortgage brokers and agents is evolving with the advent of AI. They are transitioning from being information providers to advisors who offer value-added services, guided by AI-driven insights.

Enhancing Brokerage Services with AI

Brokers and agents can use AI tools to provide more personalized and efficient services. AI can help them analyze client needs, match them with the best mortgage products, and provide timely advice.

The Need for Continuous Learning

To stay relevant in an AI-driven industry, brokers and agents need to engage in continuous learning. Understanding AI tools and how to leverage them effectively is crucial for their professional growth and service quality.

Chapter 24: AI’s Influence on Mortgage Lending Standards

Rethinking Credit Scoring

AI introduces a new perspective on credit scoring. By analyzing a broader range of data points, AI can provide a more holistic view of a borrower’s creditworthiness. This could mean more people getting access to mortgages who might have been previously overlooked due to traditional credit scoring methods.

Enhancing Lending Precision

AI’s predictive analytics can refine lending criteria, leading to more precise lending decisions. This helps in reducing defaults and increasing the overall health of the mortgage portfolio.

Dynamic Lending Policies

AI allows for the dynamic adjustment of lending policies based on real-time market data and trends. This agility ensures that lending standards remain relevant and effective in a rapidly changing economic landscape.

Chapter 25: The Role of AI in Post-Closing Mortgage Management

Streamlining Loan Servicing

AI can significantly streamline post-closing processes such as loan servicing, payment tracking, and customer support. This efficiency leads to better customer satisfaction and reduced operational costs.

Proactive Loan Monitoring

AI systems can proactively monitor loans for potential issues, such as late payments or changes in a borrower’s financial situation, allowing for timely interventions.

Automating Escrow Management

Managing escrow accounts can be complex and time-consuming. AI can automate much of this process, ensuring accuracy in payments for taxes, insurance, and other escrow items.

Chapter 26: The Global Perspective of AI in Mortgages

AI in Different Markets

The impact of AI in the mortgage industry is not limited to one region or country. Different markets around the world are adopting AI in unique ways, considering their specific regulatory and market conditions.

Bridging Economic Disparities

In some regions, AI is playing a crucial role in bridging economic disparities by enabling access to mortgage products for underserved communities. This inclusive approach is helping to democratize home ownership.

Global Collaboration and Learning

The global mortgage industry can benefit from sharing insights, experiences, and best practices in AI implementation. This collaboration fosters innovation and accelerates the effective use of AI across different markets.

Chapter 27: Embracing the Ethical Aspects of AI in Mortgages

Ensuring Fairness in AI Algorithms

A major concern with AI is the risk of inherent biases in algorithms. The industry must prioritize developing and implementing AI systems that are fair and unbiased.

Transparency in AI Decisions

Transparency in AI decision-making processes is crucial to build trust with customers. Lenders need to ensure that customers understand how AI is used in evaluating their mortgage applications.

Responsible AI Usage

Responsible AI usage involves considering the ethical implications of AI decisions. This includes respecting customer privacy, ensuring data security, and making ethically sound decisions.

Chapter 28: The Integration of AI with Mobile Technologies

Mobile-First Mortgage Solutions

In today’s world, where smartphones are ubiquitous, AI integrated with mobile technology is making mortgage services more accessible. Mobile apps powered by AI can provide instant loan comparisons, application tracking, and personalized notifications, bringing mortgage services directly to the user’s fingertips.

Enhancing User Experience on Mobile Platforms

AI enhances the user experience on mobile platforms through intuitive interfaces and predictive text input, making mortgage applications and management simpler and more user-friendly.

Real-Time Data Access and Analysis

Mobile integration allows for real-time data access and analysis, enabling borrowers and lenders to make informed decisions quickly. This immediacy is crucial in the fast-paced real estate market.

Chapter 29: AI and the Impact on Mortgage Investment Strategies

AI-Driven Investment Decisions

Investors in the mortgage market can leverage AI to analyze trends, predict market shifts, and make informed investment decisions. AI’s ability to process vast amounts of data quickly helps in identifying lucrative investment opportunities and managing risks.

Portfolio Optimization with AI

AI algorithms can assist in optimizing mortgage investment portfolios by analyzing performance data and market conditions, ensuring a balanced and profitable investment mix.

Predictive Analysis for Market Opportunities

AI’s predictive analysis capabilities can identify emerging market opportunities, enabling investors to capitalize on trends and make proactive investment moves.

Chapter 30: The Continuous Evolution of AI Technologies in Mortgages

AI and Machine Learning Advancements

As AI and machine learning technologies continue to evolve, their applications in the mortgage industry will become more sophisticated. This evolution will lead to even more efficient processing, accurate risk assessments, and personalized customer experiences.

Staying Ahead of Technological Changes

For mortgage professionals, staying abreast of these technological changes is crucial. Continuous learning and adaptation are key to leveraging the full potential of AI in the industry.

The Future of AI in Mortgage Technologies

The future of AI in mortgage technologies is not just about incremental improvements but also about groundbreaking innovations that could redefine how mortgages are processed, approved, and managed.

Chapter 31: The Role of AI in Crisis Management and Recovery

AI in Market Fluctuations and Crises

AI can play a significant role in helping the mortgage industry navigate market fluctuations and crises. By providing real-time data analysis and forecasting, AI can help in devising strategies for market resilience and recovery.

AI-Driven Stress Testing

AI-driven stress testing of mortgage portfolios can help in anticipating the impact of economic downturns and preparing for potential scenarios, ensuring better preparedness and response.

Supporting Recovery Efforts

In times of economic recovery, AI can assist in identifying areas for growth and investment, helping the mortgage industry bounce back more robustly.

Chapter 32: AI in Mortgage Data Security and Privacy

Strengthening Data Security

In the mortgage industry, where sensitive financial information is handled, AI plays a critical role in enhancing data security. AI-driven security systems can detect and neutralize threats more efficiently, safeguarding customer data against cyber-attacks and breaches.

Ensuring Privacy Compliance

AI tools help mortgage companies comply with stringent data privacy regulations. Automated compliance checks and data management systems ensure that customer data is handled responsibly, maintaining trust and integrity.

Advanced Encryption and Anonymization

AI technologies can employ advanced encryption methods and data anonymization techniques, ensuring that customer information is secure and private, further bolstering confidence in the mortgage process.

Chapter 33: The Impact of AI on Mortgage Underwriting Efficiency

Accelerating the Underwriting Process

AI dramatically accelerates the mortgage underwriting process by automating the evaluation of applications. This speed not only enhances customer satisfaction but also increases the throughput of mortgage applications, benefiting both lenders and borrowers.

Improving Underwriting Accuracy

AI algorithms can analyze a wider array of data points more accurately than traditional methods. This improved accuracy helps in reducing the risks associated with mortgage lending, leading to healthier financial portfolios.

Customizing Underwriting Criteria

AI enables the customization of underwriting criteria based on evolving market conditions and individual borrower profiles. This flexibility ensures that underwriting standards are always aligned with the current economic landscape.

Chapter 34: AI’s Role in Mortgage Compliance and Reporting

Automated Regulatory Compliance

AI systems can automate much of the regulatory compliance process, ensuring that mortgage applications and processes adhere to the latest laws and guidelines. This automation reduces the risk of non-compliance and associated penalties.

Efficient Reporting and Auditing

AI facilitates efficient and accurate reporting for regulatory purposes. Automated auditing processes can quickly identify discrepancies or issues, ensuring transparency and accountability in the mortgage process.

Staying Ahead of Regulatory Changes

AI tools can monitor regulatory changes in real time, helping mortgage companies quickly adapt their processes to comply with new requirements. This proactive approach is crucial in an industry subject to frequent regulatory shifts.

Chapter 35: Enhancing Mortgage Customer Relationship Management with AI

Personalized Customer Interactions

AI enables more personalized interactions with customers by analyzing their preferences, history, and behavior. This personalization can lead to stronger customer relationships and higher satisfaction levels.

Predictive Customer Service

AI can predict customer needs and issues before they arise, allowing mortgage providers to offer proactive solutions. This predictive customer service can significantly enhance the customer experience.

Automating Customer Engagement

AI-driven tools can automate routine customer engagement tasks, like sending reminders for document submissions or payment due dates, ensuring consistent and timely communication.

Chapter 36: AI and Mortgage Lending in the Digital Age

The Digital Mortgage Experience

In the digital age, AI is the cornerstone of a seamless online mortgage experience. It streamlines the application process, making it quick, easy, and accessible from anywhere. This convenience is a game-changer for tech-savvy borrowers who prefer digital interactions over traditional methods.

Enhancing Online Security

As mortgage processes move online, AI plays a crucial role in enhancing digital security. It helps detect and prevent online frauds, safeguarding both lenders and borrowers in the digital mortgage landscape.

Virtual Property Appraisals

AI can facilitate virtual property appraisals by analyzing property data, market trends, and historical transactions. This digital approach not only saves time but also provides a comprehensive evaluation of property value.

Chapter 37: The Future of AI and Augmented Reality in Mortgages

Augmented Reality in Property Tours

Imagine exploring a property virtually with augmented reality (AR) integrated with AI. This technology can provide potential buyers with an immersive property viewing experience, enhancing their decision-making process.

Interactive Mortgage Applications

In the near future, AR combined with AI could transform mortgage applications into interactive experiences. Borrowers could visualize loan scenarios, understand terms better, and make informed decisions in an engaging, virtual environment.

AR for Property Improvement and Valuation

AR can also assist in visualizing property improvements and estimating their impact on property value. This can be particularly useful for borrowers considering mortgages for home renovations or property investments.

Chapter 38: AI’s Role in Mortgage Education and Awareness

AI-Powered Financial Literacy Programs

AI can play a pivotal role in educating borrowers about mortgages. Through interactive learning modules and personalized content, AI can demystify mortgage concepts, making financial education more accessible and engaging.

Community Outreach Programs

AI-driven platforms can be used for community outreach, providing valuable mortgage information to underserved communities. This approach can help in bridging the knowledge gap and promoting financial inclusion.

Continuous Learning for Mortgage Professionals

AI not only educates borrowers but also provides continuous learning opportunities for mortgage professionals. AI-driven training programs can keep them updated on the latest trends, technologies, and best practices.

Chapter 39: The Interplay of AI and Human Judgment in Mortgage Lending

The Balance of AI and Human Expertise

While AI brings efficiency and accuracy, the human element remains vital in mortgage lending. The interplay between AI’s analytical capabilities and human judgment ensures a more balanced and empathetic approach to lending.

AI as a Decision-Support Tool

AI serves as a decision-support tool for mortgage professionals, providing them with insights and recommendations. However, the final decision often involves human discretion, especially in complex or borderline cases.

Ethical Considerations in AI Lending

The ethical use of AI in mortgage lending is paramount. Ensuring that AI systems are fair, unbiased, and transparent is crucial to maintaining ethical lending practices.

Chapter 40: AI in Enhancing Mortgage Refinancing and Restructuring

Streamlining Refinancing Processes

AI significantly streamlines the mortgage refinancing process, making it quicker and more efficient for borrowers to take advantage of favorable market conditions. It can quickly analyze current rates, borrower eligibility, and potential savings, providing a hassle-free refinancing experience.

Intelligent Restructuring of Mortgages

For borrowers facing financial challenges, AI can assist in restructuring their mortgages. By analyzing financial data, AI can propose restructuring options that align with the borrower’s current financial situation, aiding in debt management and financial stability.

Predictive Analysis for Refinancing Opportunities

AI’s predictive analysis capabilities can alert borrowers to potential refinancing opportunities, helping them to capitalize on lower interest rates and better loan terms at the right time.

Chapter 41: AI’s Influence on International Mortgage Lending Practices

Global Lending Insights

AI provides valuable insights into international mortgage markets, allowing lenders to understand and adapt to different regulatory environments and consumer behaviors. This global perspective is essential for lenders operating in multiple countries or looking to expand internationally.

Cross-Border Mortgage Transactions

AI can facilitate cross-border mortgage transactions by handling currency conversions, complying with international regulations, and providing localized customer support, making international property investments more accessible.

Harmonizing Diverse Mortgage Practices

AI helps in harmonizing mortgage practices across different countries. By analyzing various regulatory frameworks and market conditions, AI can guide lenders in offering standardized yet localized mortgage products.

Chapter 42: The Integration of AI with Traditional Mortgage Banking

Blending AI with Conventional Banking

In traditional mortgage banking, AI acts as a bridge between classic banking practices and modern technology. It enhances traditional processes with speed, accuracy, and efficiency while retaining the foundational principles of mortgage banking.

Enhancing Traditional Banking Services

AI enhances traditional mortgage banking services by introducing automated customer support, faster loan processing, and more accurate risk assessments, thus improving the overall customer experience.

Training Bank Staff for AI Adoption

To successfully integrate AI into traditional banking, staff training is essential. Employees need to be equipped with the skills to work alongside AI tools, ensuring a seamless blend of technology and human service.

Chapter 43: The Ethical Deployment of AI in Mortgage Decisions

Ensuring Non-Discriminatory AI Practices

One of the critical concerns in deploying AI is ensuring it doesn’t perpetuate or introduce discriminatory practices. Mortgage companies must rigorously test AI algorithms for biases and ensure equitable lending practices.

Transparent AI Systems

Transparency in AI systems is crucial for building trust. Lenders should be open about how AI is used in decision-making processes and ensure that customers have a clear understanding of AI’s role in their mortgage applications.

The Importance of Ethical AI Governance

Establishing ethical governance for AI use in mortgage decisions is paramount. This includes setting clear guidelines for AI development and use, monitoring AI systems for ethical compliance, and ensuring accountability.

Chapter 44: AI’s Role in Mortgage Payment and Collection

Automating Payment Processing

AI revolutionizes mortgage payment processing by automating transactions, ensuring timely and accurate payments. This automation reduces errors and enhances the efficiency of the collection process.

Predictive Payment Behavior Analysis

AI can analyze borrower payment patterns, predicting potential late payments or defaults. This enables lenders to proactively manage risks and offer solutions, such as flexible payment plans, to borrowers in need.

Enhancing Payment Security

AI also plays a crucial role in enhancing the security of mortgage payments. By detecting and preventing fraudulent activities, AI ensures a safe and secure transaction environment for both borrowers and lenders.

Chapter 45: AI and Environmental Sustainability in Mortgages

AI in Green Mortgage Initiatives

AI aids in the promotion of green mortgages, which offer favorable terms for energy-efficient homes. By analyzing property data and environmental factors, AI can identify properties that qualify for green mortgages, promoting environmental sustainability.

Assessing Environmental Risks

AI can evaluate environmental risks associated with properties, such as susceptibility to natural disasters. This helps in making informed lending decisions and promoting sustainable development practices.

Encouraging Sustainable Homeownership

Through AI, lenders can offer advice and incentives for energy-efficient home improvements, encouraging sustainable homeownership and contributing to broader environmental goals.

Chapter 46: The Impact of AI on Mortgage Industry Employment

The Shift in Job Roles

AI in the mortgage industry leads to a shift in job roles. While some traditional tasks become automated, new roles emerge, focusing on AI management, data analysis, and customer experience enhancement.

Training and Upskilling Opportunities

The adoption of AI creates numerous opportunities for training and upskilling. Mortgage professionals can enhance their skills in AI operation, data management, and digital customer service, staying relevant in an evolving industry.

Creating High-Value Jobs

AI automation allows employees to focus on high-value tasks that require human judgment and expertise, such as complex case handling and personalized customer advice, leading to more fulfilling and impactful job roles.

Chapter 47: The Role of AI in Mortgage Industry Analytics and Research

Advanced Market Analytics

AI performs advanced analytics on market trends, borrower behaviors, and economic indicators, providing valuable insights for strategic decision-making and market positioning.

Predictive Modeling for Industry Trends

AI’s predictive modeling capabilities enable mortgage companies to foresee industry trends, helping them to adapt their strategies proactively and maintain a competitive edge.

Data-Driven Product Development

AI assists in data-driven product development, enabling lenders to design mortgage products that meet evolving customer needs and market demands.

Chapter 48: AI in Enhancing Cross-Industry Collaboration

Collaborative Ecosystems

AI fosters collaborative ecosystems between the mortgage industry and other sectors, such as real estate, insurance, and legal services. This collaboration leads to integrated services, providing a more comprehensive experience for customers.

Streamlining Inter-Industry Processes

AI streamlines processes between industries, enhancing efficiency in areas like property valuation, insurance underwriting, and legal compliance, leading to smoother transactions for borrowers.

Shared AI Platforms

The development of shared AI platforms can facilitate information exchange and joint ventures between industries, leading to innovative solutions and enhanced services in the mortgage process.

Chapter 49: AI in Enhancing Mortgage Customer Retention and Loyalty

Personalized Customer Engagement

AI enables mortgage companies to engage with customers on a more personal level. By analyzing customer data, AI can deliver personalized communication, offers, and advice, significantly enhancing customer satisfaction and loyalty.

Predicting and Addressing Customer Needs

AI’s predictive analytics can anticipate customer needs, allowing mortgage providers to offer timely solutions and services. This proactive approach helps in retaining customers by consistently meeting or exceeding their expectations.

Improving Customer Service Quality

AI-driven tools, like chatbots and virtual assistants, can provide high-quality, consistent customer service. This accessibility and efficiency contribute to a positive customer experience, fostering loyalty and trust.

Chapter 50: AI in Global Mortgage Market Adaptation

Adapting to Diverse Markets

AI helps mortgage companies adapt to diverse global markets by analyzing regional trends, regulatory differences, and cultural nuances. This adaptability is crucial for companies operating internationally or planning to expand into new markets.

Overcoming Language and Cultural Barriers

AI-powered tools can overcome language and cultural barriers, offering services in multiple languages and adapting communication styles to suit different cultures. This inclusivity enhances the global reach of mortgage services.

Global Risk Assessment

AI can assess risks in international mortgage markets, providing insights into economic, political, and social factors that might affect lending and investment decisions. This global risk assessment is essential for making informed international mortgage decisions.

Chapter 51: The Future of Remote Mortgage Processing with AI

Streamlining Remote Mortgage Applications

The future of mortgages is increasingly remote, and AI is at the forefront of this transition. AI streamlines remote mortgage applications, making it possible to apply for and manage mortgages from anywhere, without the need for physical interactions.

Enhancing Virtual Property Inspections

AI, combined with virtual reality technologies, can enhance virtual property inspections, providing detailed and accurate property assessments remotely, saving time and resources for both borrowers and lenders.

Secure Remote Document Handling

AI ensures secure handling of documents in remote mortgage processing, using advanced encryption and verification methods to protect sensitive information in a digital environment.

Chapter 52: The Role of AI in Mortgage Industry Sustainability

Promoting Sustainable Lending Practices

AI aids mortgage companies in adopting sustainable lending practices by analyzing environmental impacts and guiding investment towards environmentally friendly properties and projects.

AI in Carbon Footprint Analysis

AI can analyze the carbon footprint of mortgage portfolios, helping companies understand their environmental impact and make changes towards more sustainable practices.

Supporting Green Financing

AI supports the growth of green financing in the mortgage industry, identifying opportunities for investment in sustainable properties and renewable energy projects, contributing to the industry’s overall sustainability goals.

Chapter 53: AI in Mortgage Industry Regulation and Compliance

Navigating Regulatory Landscapes

AI helps mortgage companies navigate complex regulatory landscapes by keeping track of changing laws and regulations across different regions. This ensures compliance and reduces the risk of legal complications.

Automating Compliance Processes

AI automates various compliance processes, such as reporting and auditing, making them more efficient and less prone to errors. This automation is essential in maintaining high standards of regulatory adherence.

Enhancing Regulatory Reporting

AI improves the accuracy and timeliness of regulatory reporting. By processing vast amounts of data quickly, AI ensures that mortgage companies can meet regulatory requirements without delays or inaccuracies.

Chapter 54: The Intersection of AI and Traditional Mortgage Counseling

Enhancing Traditional Counseling with AI

AI complements traditional mortgage counseling by providing counselors with advanced tools and data insights. This enhances their ability to offer accurate and personalized advice to clients.

AI-Assisted Risk Assessment for Counselors

Mortgage counselors can use AI to assess the risks associated with different mortgage options. This helps in providing clients with well-informed advice that aligns with their financial goals and circumstances.

Continuous Training for Counselors

As AI becomes more integrated into the mortgage process, ongoing training for mortgage counselors is crucial. They need to stay updated on AI tools and technologies to effectively integrate them into their counseling services.

Chapter 55: AI’s Impact on Mortgage Industry Standards and Best Practices

Setting New Industry Standards

AI is setting new standards in the mortgage industry for efficiency, accuracy, and customer service. These standards are elevating the quality of services across the industry.

Developing Best Practices

As AI continues to be integrated into various aspects of mortgage processing, it’s leading to the development of best practices. These include data handling, customer interaction, and process automation, guiding the industry towards consistent excellence.

Benchmarking Performance with AI

AI enables mortgage companies to benchmark their performance against industry standards and competitors. This benchmarking helps in identifying areas for improvement and driving innovation.

Chapter 56: AI and the Democratization of Mortgage Services

Making Mortgages More Accessible

AI is democratizing mortgage services by making them more accessible to a wider audience. Automated processes and personalized services are breaking down barriers, allowing more people to access mortgage products.

Bridging the Financial Divide

AI helps bridge the financial divide by providing services to underserved and low-income communities. By analyzing alternative data points, AI can assess the creditworthiness of individuals who lack traditional credit histories.

Promoting Financial Inclusion

AI plays a crucial role in promoting financial inclusion. It offers tailored mortgage products and services to various segments of society, ensuring that more people can realize their dream of homeownership.

Chapter 57: AI in Customizing Mortgage Products for Diverse Populations

Tailored Mortgage Solutions

AI’s data analysis capabilities enable lenders to design mortgage products that cater to the unique needs of diverse populations. By understanding different borrower profiles, AI can help in crafting solutions that address specific financial situations and preferences.

Understanding Cultural and Demographic Needs

AI tools can analyze cultural and demographic data to understand the specific needs of various communities. This understanding is crucial in developing mortgage products that are sensitive to cultural nuances and demographic factors.

Enhancing Accessibility for All

AI-driven customization of mortgage products enhances accessibility, ensuring that different groups, including those traditionally underserved by financial institutions, have access to suitable mortgage options.

Chapter 58: The Role of AI in Future Mortgage Technology Innovations

Pioneering New Technologies

AI is not just integrating with existing technologies; it’s also pioneering new ones. These innovations could include advanced predictive models, new forms of data analysis, and even more interactive customer service technologies.

AI in Blockchain and Mortgage Security

AI’s role in enhancing blockchain technology for mortgage security is promising. AI can improve the efficiency and reliability of blockchain-based transactions and record-keeping, offering an added layer of security in mortgage dealings.

Exploring AI and IoT in Smart Homes

The intersection of AI and IoT in smart homes presents exciting possibilities for the mortgage industry. AI could analyze data from smart homes to assess property value, energy efficiency, and even predict maintenance needs.

Chapter 59: The Future of Work in the AI-Driven Mortgage Industry

Job Evolution and AI

In an AI-driven mortgage industry, jobs are evolving. Roles are shifting from routine tasks to more strategic and analytical positions. Employees need to adapt to these changes, embracing new skills and roles.

AI in Enhancing Employee Productivity

AI tools can enhance employee productivity by taking over repetitive tasks, allowing mortgage professionals to focus on complex, value-added activities that require human insight and expertise.

Training and Development in the AI Era

Continuous training and development are essential in the AI era. Mortgage professionals must stay abreast of AI advancements and learn to work effectively with AI systems to remain competitive and efficient.

Chapter 60: AI’s Contribution to Global Mortgage Market Stability

Predictive Analysis for Market Stability

AI contributes to global mortgage market stability through predictive analysis. By forecasting economic trends and identifying potential market disruptions, AI helps lenders and investors make informed decisions to maintain market stability.

AI in Crisis Prediction and Management

AI can play a crucial role in crisis prediction and management in the mortgage industry. By identifying early warning signs of market instability, AI enables proactive measures to mitigate risks.

Supporting International Economic Policies

AI supports the development and implementation of international economic policies in the mortgage sector. By providing data-driven insights, AI aids policymakers in creating regulations and policies that promote global financial stability.

Chapter 61: AI in Mortgage Loan Origination and Processing

Streamlining Loan Origination

AI revolutionizes the loan origination process by automating and streamlining tasks. This includes everything from initial application sorting to document verification and preliminary credit checks, significantly reducing processing time and improving efficiency.

Enhancing Accuracy in Application Assessment

AI algorithms can analyze loan applications with a high degree of accuracy, reducing the likelihood of errors. This ensures that loan origination is not only faster but also more reliable, benefiting both lenders and borrowers.

Customizing Loan Offers

With AI, lenders can customize loan offers based on individual borrower profiles. AI’s ability to analyze vast amounts of data enables lenders to offer loans that are more closely aligned with a borrower’s financial capability and needs.

Chapter 62: AI’s Role in Mortgage Servicing and Management

Efficient Mortgage Servicing

AI transforms mortgage servicing by automating routine tasks such as payment processing, account updates, and customer notifications. This increases operational efficiency and improves customer satisfaction.

Proactive Loan Management

AI tools can proactively manage loans by monitoring payment patterns and identifying potential issues early. This allows for timely interventions to prevent defaults and maintain healthy loan portfolios.

Enhancing Customer Service

AI-driven chatbots and virtual assistants provide borrowers with instant assistance and answers to their queries. This 24/7 customer service capability significantly enhances the borrower experience.

Chapter 63: AI in Real Estate and Mortgage Market Analytics

Advanced Real Estate Market Analysis

AI provides deep insights into real estate market trends by analyzing vast amounts of data, including prices, demographics, and economic indicators. This helps lenders and investors make more informed decisions.

Predictive Analytics in Mortgage Lending

AI’s predictive analytics are crucial in assessing future trends in mortgage lending. This helps lenders anticipate market changes, adjust their strategies accordingly, and stay competitive.

Custom Market Reports

AI can generate customized market reports tailored to specific needs, providing valuable insights to mortgage professionals, real estate agents, and investors.

Chapter 64: AI in Enhancing Mortgage Portfolio Management

Optimizing Portfolio Performance

AI algorithms can optimize mortgage portfolio performance by analyzing various risk factors and market conditions. This leads to better risk management and increased portfolio profitability.

Dynamic Portfolio Adjustment

AI enables dynamic adjustment of mortgage portfolios in response to changing market conditions. This agility is essential for maintaining the health and performance of the portfolio over time.

Data-Driven Investment Decisions

For investors, AI provides data-driven insights that guide investment decisions in the mortgage market. By analyzing market trends and portfolio performance, AI helps in identifying profitable investment opportunities.

Chapter 65: AI in Enhancing Loan Repayment and Default Management

Predicting Loan Repayment Patterns

AI helps lenders predict loan repayment patterns, identifying borrowers who might be at risk of default. This enables proactive management strategies, such as offering restructuring options or personalized repayment plans.

Managing Defaults Effectively

In cases of default, AI systems can optimize recovery processes by analyzing borrower data to determine the most effective recovery strategy. This approach helps minimize losses while maintaining a positive borrower-lender relationship.

Automated Payment Reminders and Negotiations

AI-driven systems can automate payment reminders and facilitate negotiation of repayment terms. This helps maintain consistent communication with borrowers and aids in the management of overdue accounts.

Chapter 66: The Role of AI in Mortgage Industry Sustainability and CSR

Supporting Sustainable Lending Practices

AI contributes to sustainability in the mortgage industry by identifying and promoting lending practices that are environmentally and socially responsible. This includes supporting green mortgages and sustainable development projects.

Enhancing Corporate Social Responsibility (CSR)

AI can help mortgage companies in their CSR initiatives by identifying areas where they can make a positive impact, such as community development programs or affordable housing projects.

Tracking and Reporting on Sustainability Goals

AI tools can track and report on a company’s progress towards sustainability goals. This transparent reporting is crucial for stakeholders who are increasingly interested in the social and environmental impacts of mortgage lending.

Chapter 67: AI in Mortgage Industry Regulatory Technology (RegTech)

Streamlining Compliance Processes

AI is a powerful tool in RegTech for the mortgage industry, streamlining compliance processes and reducing the burden of regulatory requirements. By automating tasks like data collection and reporting, AI ensures more efficient compliance.

Real-Time Regulatory Monitoring

AI systems can monitor regulatory changes in real-time, ensuring that mortgage companies are always up-to-date with the latest requirements. This proactive approach reduces the risk of non-compliance.

Enhancing Risk Management

AI in RegTech also enhances risk management by identifying potential regulatory risks and suggesting mitigating strategies. This helps companies maintain robust compliance postures.

Chapter 68: AI’s Role in Mortgage Industry Training and Education

Personalized Training Programs

AI can provide personalized training programs for mortgage professionals, tailoring content to individual learning styles and knowledge levels. This personalized approach ensures more effective and engaging training.

Continuous Professional Development

With AI, mortgage professionals can engage in continuous professional development. AI-driven learning platforms can offer up-to-date content on industry trends, technology advancements, and regulatory changes.

Enhancing Educational Resources for Borrowers

AI also enhances educational resources for borrowers, providing them with accessible and understandable information about mortgages. This empowers borrowers to make informed decisions about their mortgage options.

Chapter 69: AI in Mortgage Market Forecasting and Strategy

Advanced Market Forecasting

AI’s advanced forecasting abilities provide invaluable insights into future mortgage market trends. By analyzing historical data and current market indicators, AI helps lenders and investors anticipate changes and adapt their strategies accordingly.

Strategic Planning with AI

AI aids in strategic planning by providing comprehensive market analyses, including demand forecasting, interest rate predictions, and economic impact assessments. This information is crucial for developing long-term business strategies in the mortgage industry.

Competitive Analysis

AI tools can conduct in-depth competitive analyses, helping mortgage companies understand their market position, identify strengths and weaknesses, and adjust their strategies to gain a competitive edge.

Chapter 70: The Integration of AI in Mortgage Customer Relationship Management (CRM)

Personalized Customer Journeys

AI transforms CRM in the mortgage industry by creating personalized customer journeys. It analyzes individual customer data to provide tailored services, advice, and product recommendations.

Enhanced Customer Interaction

AI-driven CRM tools enable more meaningful and efficient customer interactions. Chatbots and virtual assistants provide immediate assistance, while AI-driven analytics help understand and predict customer needs.

Customer Retention Strategies

AI helps in developing effective customer retention strategies. By analyzing customer behavior and feedback, AI identifies factors that influence customer satisfaction and loyalty, helping companies improve their service offerings.

Chapter 71: AI’s Impact on Mortgage Industry Innovation and Research

Driving Technological Innovation

AI is a driving force behind technological innovation in the mortgage industry. It encourages the development of new tools and applications that streamline processes, enhance decision-making, and improve customer experiences.

Facilitating Research and Development

AI facilitates research and development within the mortgage sector. By analyzing large datasets, AI identifies areas ripe for innovation, helping companies focus their R&D efforts more effectively.

Collaborative Research Opportunities

AI opens up opportunities for collaborative research between mortgage companies, technology firms, and academic institutions. These collaborations can lead to groundbreaking advancements and new approaches to mortgage lending.

Chapter 72: The Future of AI in Global Mortgage Markets

Global Market Adaptation

AI helps mortgage companies adapt to global markets by providing insights into different regulatory environments, cultural nuances, and economic conditions. This global adaptability is key to successful international operations.

Bridging Global Mortgage Gaps

AI bridges gaps in global mortgage markets by offering solutions tailored to diverse international needs. This includes providing localized products, understanding different customer profiles, and adapting to various regulatory frameworks.

Fostering International Collaboration

AI fosters international collaboration in the mortgage industry. By sharing data and insights across borders, AI enables a more cohesive and interconnected global mortgage market.

Conclusion

As we reach the end of our exploration into AI’s role in the mortgage industry, it’s evident that AI is not just a tool but a transformative force reshaping every facet of the industry.

From market forecasting and CRM to driving innovation and adapting to global markets, AI’s impact is extensive and profound. Looking ahead, AI promises a future of enhanced efficiency, deeper market insights, and more personalized customer experiences.

The mortgage industry, powered by AI, is on a path towards greater innovation, global integration, and continual evolution. This journey with AI at the helm is paving the way for a mortgage industry that is not only technologically advanced but also more aligned with the diverse and changing needs of customers worldwide.

As we embrace this future, the industry is poised to become more dynamic, responsive, and inclusive, heralding a new era of mortgage lending that is both intelligent and interconnected.

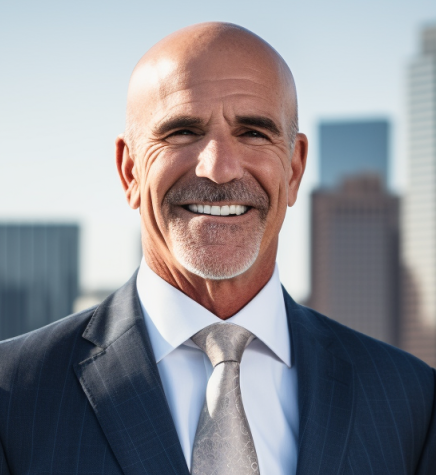

Too discrete to give his real age (but certainly in the grizzled veteran bracket), Tom is an Army brat who spent much of his childhood overseas. After moving back to Florida in the 80’s with his family, Tom worked a variety of jobs after college before finding his calling in the mortgage industry. Now, adding his decades worth of experience to this site, Tom hopes to help others with his knowledge.

After working through the 2008 crisis in a hard hit bank, Tom knows only too well the impact his industry has on people’s lives. Now semi-retired, Tom spends his days keeping up with the latest news in the mortgage industry (and finding the odd hour or three to fish).