USC’s Real Estate Growth Forecast: A Look into Late 2010

In the wake of the 2008 financial crisis, the real estate market in the United States underwent significant turbulence. The University of Southern California’s Lusk Center for Real Estate, a leading authority in real estate research and analysis, projected a period of stagnation in real estate growth extending until late 2010. This forecast was a reflection of the broader economic challenges that the country faced during this period.

The State of Real Estate Post-2008

The financial crisis of 2008 had a cascading effect on various sectors, with real estate being one of the most impacted. The crisis led to a dramatic slowdown in housing sales, a decline in property values, and a significant drop in new construction. The USC Lusk Center’s forecast indicated that the commercial real estate market wouldn’t see growth for at least two years, a stark indicator of the times.

Factors Influencing the Slowdown

Several key factors contributed to this extended period of stagnation in the real estate market:

- Credit Crunch: Financial institutions, reeling from the crisis, tightened lending standards, making it difficult for buyers to secure mortgages.

- Consumer Confidence: The economic downturn led to a decline in consumer confidence, which in turn reduced the demand for real estate.

- Over-supply: The years leading up to the crisis saw a construction boom, resulting in an oversupply of properties in certain markets.

The Ripple Effect

The slowdown in real estate growth had a ripple effect on the economy. It impacted construction jobs, real estate agents, mortgage lenders, and a host of other professions connected to the real estate sector. The USC Lusk Center’s forecast highlighted the interconnectedness of real estate with the broader economy.

Looking Towards Late 2010

The forecast by the USC Lusk Center suggested that recovery in the real estate market would be gradual, stretching into the latter part of 2010. This recovery was expected to be influenced by:

- Economic Recovery: As the overall economy recovered, so too would the real estate market.

- Improving Credit Availability: As financial institutions stabilized, credit was expected to become more accessible.

- Adjustment of Prices: The correction in property prices was expected to stimulate demand gradually.

Conclusion

The USC Lusk Center for Real Estate’s forecast served as a sobering reminder of the challenges faced by the real estate market post-2008. However, it also pointed towards a gradual recovery, aligning with the healing of the broader economy. As history unfolded, the real estate market did begin to show signs of recovery towards the end of 2010, in line with the USC Lusk Center’s predictions, marking the beginning of a new chapter in the sector’s evolution.

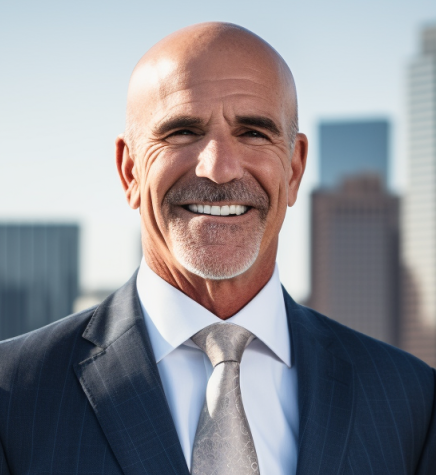

Too discrete to give his real age (but certainly in the grizzled veteran bracket), Tom is an Army brat who spent much of his childhood overseas. After moving back to Florida in the 80’s with his family, Tom worked a variety of jobs after college before finding his calling in the mortgage industry. Now, adding his decades worth of experience to this site, Tom hopes to help others with his knowledge.

After working through the 2008 crisis in a hard hit bank, Tom knows only too well the impact his industry has on people’s lives. Now semi-retired, Tom spends his days keeping up with the latest news in the mortgage industry (and finding the odd hour or three to fish).